When you sign a contract-whether you're buying a business, licensing software, or hiring a vendor-you're not just agreeing to pay for something. You're also agreeing to take on risk. And that’s where liability and indemnification come in. These aren’t just legal buzzwords. They’re the backbone of how businesses protect themselves when things go wrong.

What Does Indemnification Actually Mean?

Indemnification is a promise in a contract: one party agrees to pay the other if something bad happens because of their actions. It’s not about blame-it’s about who pays the bill. For example, if you buy a piece of software and it turns out the vendor stole someone else’s code, the vendor might have to cover your legal fees, any fines, and even lost profits. That’s indemnification in action.

It’s not magic. It’s a contract clause. And it’s in almost every commercial deal you’ll ever sign. According to legal experts, these clauses appear in nearly all business agreements, from small service contracts to billion-dollar mergers. The point? To shift risk before the problem even happens.

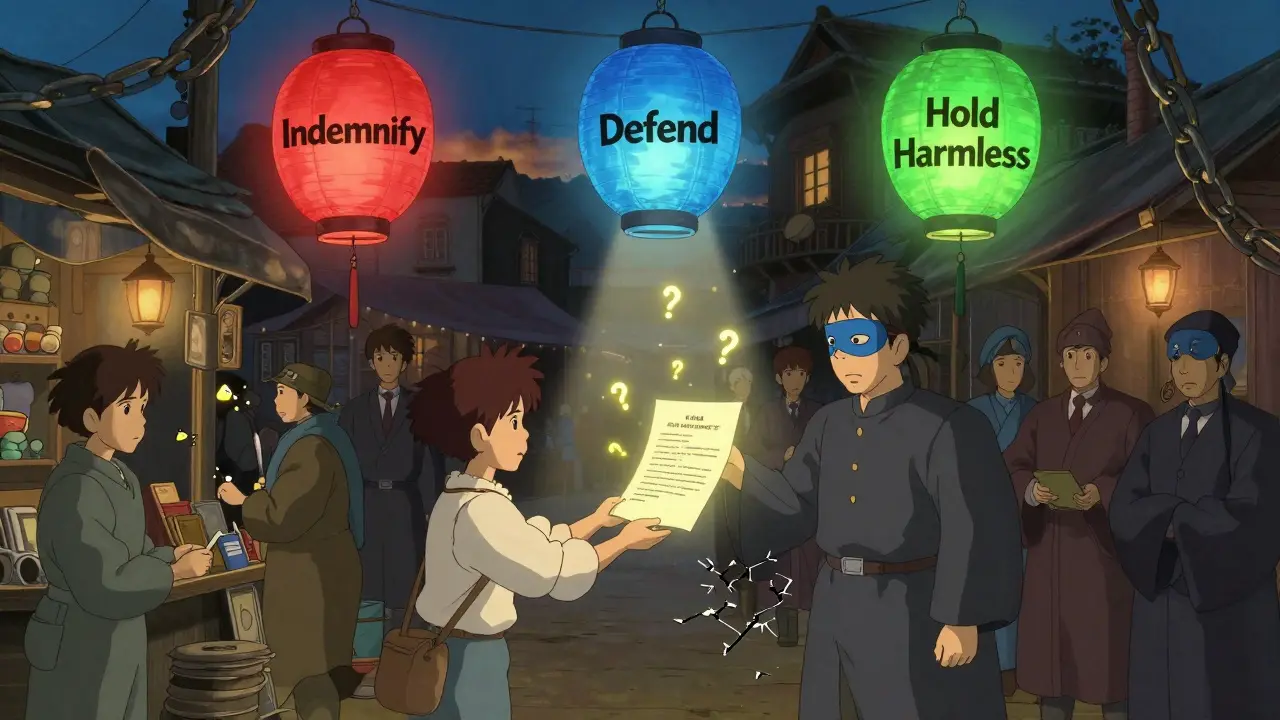

Three Key Words: Indemnify, Defend, Hold Harmless

Many contracts use all three phrases together: “indemnify, defend, and hold harmless.” But they mean different things-and mixing them up can cost you.

- Indemnify means: pay for losses. If a lawsuit costs $200,000, the indemnifying party writes the check.

- Defend means: pay for lawyers. Even if you’re not at fault, the other side has to cover your legal costs if a claim arises under the contract.

- Hold harmless means: don’t sue me back. If you’re protected under this clause, the other party can’t turn around and try to make you pay for something they caused.

These aren’t interchangeable. A poorly written clause might leave you paying for legal fees but not damages-or worse, being sued by the very party you thought was protecting you.

What Triggers Indemnification?

Not every mistake triggers a payout. The contract has to say exactly what will set it off. Common triggers include:

- Breach of warranty (e.g., “We own all the IP in this product” - but you later find out we don’t)

- Negligence or misconduct (e.g., a vendor’s security failure leads to a data breach)

- Violation of law (e.g., the product violates environmental rules)

- Third-party claims (e.g., a customer sues you because the vendor’s product hurt them)

Let’s say you’re a retailer and you buy inventory from a supplier. Later, a customer gets injured using one of their products. If the supplier didn’t warn you about a known defect, and your contract says they’ll indemnify you for product liability claims, they owe you for your legal defense, any settlement, and even the cost of pulling the product off shelves.

Seven Parts of a Strong Indemnification Clause

Not all indemnity clauses are created equal. A good one doesn’t just say “we’ll protect you.” It spells out the details. Here’s what you need to look for:

- Scope of Coverage - What kinds of losses are included? Legal fees? Lost profits? Regulatory fines? Make sure it’s clear.

- Triggering Events - Exactly what actions or failures will activate the obligation? Vague language like “any claim related to this agreement” is dangerous.

- Duration - How long does the protection last? Some clauses expire when the contract ends. Others last years, especially for things like tax liability or IP infringement.

- Limitations - Is there a cap? A deductible? Many contracts limit indemnity to the total contract value or exclude indirect damages like lost business.

- Claim Procedures - How do you ask for money? Do you have to notify them within 30 days? In writing? With evidence? Miss the deadline, and you lose your right.

- Insurance Requirements - Does the indemnifying party have to carry insurance? If so, how much? A $1 million cap means nothing if they’re broke.

- Governing Law and Jurisdiction - Where will disputes be settled? In Sydney? New York? The law in each place treats indemnity differently.

Mutual vs. Unilateral: Who Pays Whom?

Some contracts have mutual indemnity: both sides protect each other. That’s common in joint ventures or construction projects where both parties could cause harm.

But more often, it’s one-sided. In software deals, the vendor usually indemnifies the buyer. In M&A deals, the seller indemnifies the buyer for hidden liabilities. Why? Because one party has more control-or more to lose.

For example: if you’re a big bank buying a fintech startup, you’ll demand the seller indemnify you for any undisclosed debts, tax issues, or IP violations. The startup has less power, so they agree-even if it’s risky for them.

Fundamental vs. Non-Fundamental Representations

Not all promises in a contract are equal. Some are core to the deal. Others are details.

- Fundamental reps - These are the bedrock: ownership of assets, legal authority to sign, no hidden liabilities, tax compliance. These usually have longer survival periods-sometimes 3 to 5 years after closing.

- Non-fundamental reps - These cover things like employee benefits, contracts with suppliers, or minor IP rights. These often expire after 12 to 18 months.

Why does this matter? Because indemnification kicks in only if a representation turns out to be false. If a seller says “we have no pending lawsuits,” but you find out there’s one hiding in the background, you can claim indemnification. But only if that promise was part of a representation that’s still alive.

Why Sellers Should Be Careful

Indemnification clauses are often the most heavily negotiated part of a deal-and sellers usually lose the most.

Buyers want broad protection. Sellers want to limit exposure. That’s the tension. Sellers often end up agreeing to cover:

- Every single misstatement in the contract

- Legal fees for claims that turn out to be baseless

- Losses that weren’t even their fault

Smart sellers push back. They cap indemnity at the deal price. They exclude consequential damages. They require notice within 30 days. They demand proof of actual loss. They insist on insurance. They fight for survival periods that match the risk-not the buyer’s wish list.

What Happens If There’s No Indemnification Clause?

If your contract doesn’t have one, you’re relying on the law. And the law doesn’t help much.

In Australia, under common law, you can sue for breach of contract-but you have to prove fault, causation, and damages. It’s expensive, slow, and uncertain. Indemnification clauses remove that guesswork. They give you a clear path to recovery.

Without one, you might end up paying for a vendor’s mistake out of your own pocket. And if they go bankrupt? You’re out of luck.

Real-World Example: The Data Breach

Imagine this: You run a small online store. You hire a third-party company to handle your customer payments. Their system gets hacked. 50,000 customers’ credit card details are stolen. You get fined by the ACCC. You pay for credit monitoring. You lose sales. Your brand is damaged.

If your contract with the payment processor says they’ll indemnify you for data breaches caused by their negligence, you can demand they cover all those costs. If it doesn’t? You’re on your own.

That’s why top businesses always include indemnification in vendor contracts. Not because they expect problems. But because they know problems happen.

How to Negotiate Better Indemnity Terms

Here’s what works in practice:

- For buyers: Start with broad language. Push for no caps on legal fees. Demand insurance certificates before signing.

- For sellers: Limit scope. Exclude indirect damages. Cap liability at contract value. Require written notice within 15-30 days. Push for survival periods that match the risk.

- For both: Define “losses” clearly. Include legal fees, settlements, fines, and even public relations costs if relevant.

- Always tie indemnity to actual fault. Don’t agree to cover claims that aren’t your fault.

And never sign a contract with a boilerplate indemnity clause. If it looks like it was copied from a 10-year-old template, it’s probably broken.

Final Thought: Indemnification Isn’t Insurance

It’s tempting to think indemnification is like insurance. It’s not. Insurance pays out based on an event. Indemnification pays out only if the contract says so-and only if you follow the rules.

One missed deadline. One vague word. One missing insurance certificate. And your protection vanishes.

That’s why these clauses aren’t just legal fine print. They’re your financial safety net. Get them right, and you sleep better. Get them wrong, and you might be paying for someone else’s mistake-for years.

What’s the difference between liability and indemnification?

Liability means you’re legally responsible for harm caused by your actions. Indemnification is a contract promise where someone else agrees to cover your losses if you’re held liable. You can be liable without indemnification-and indemnification doesn’t automatically make you not liable.

Can I indemnify myself?

No. Indemnification requires two parties: one promising to pay, and one receiving payment. You can’t indemnify yourself because there’s no risk transfer. It’s like saying, “I’ll pay myself if I break something.” That doesn’t change your responsibility.

Do indemnification clauses expire?

Yes. Most have a survival period-often 12 to 36 months after the contract ends. Fundamental warranties (like ownership of assets) may last longer, sometimes up to 5 years. Always check the clause for the exact timeline.

What if the other party goes bankrupt?

If the indemnifying party goes broke, you’re unlikely to get paid-even if the contract says they owe you. That’s why insurance requirements matter. Always require proof of coverage (like a certificate of insurance) before signing.

Are indemnification clauses enforceable in Australia?

Yes, as long as they’re clear, reasonable, and don’t violate public policy. Australian courts generally uphold well-drafted indemnity clauses. But vague or overly broad language can be struck down. Courts also won’t enforce clauses that try to cover gross negligence or fraud.

Should I always ask for indemnification in every contract?

Not always. For low-risk, low-value deals, it may not be worth the negotiation. But for any contract involving money, data, safety, or long-term obligations, indemnification is essential. Think of it like seatbelts: you hope you never need it-but you don’t drive without it.

14 Comments

Write a comment

More Articles

The Essential Guide to Salvia Divinorum: Everything You Need to Know About This Powerful Dietary Supplement

In my latest blog post, I delve into the fascinating world of Salvia Divinorum, a powerful dietary supplement that's been gaining popularity. I've compiled an essential guide, covering all the important aspects from its origin and benefits to side effects and safety measures. I've also touched on its legal status and how it can be used for various health-related purposes. This blog aims to provide a comprehensive understanding of Salvia Divinorum, making it easier for you to decide whether it's right for your dietary needs. Make sure to check it out if you're curious about this intriguing supplement!

Exploring Bimatoprost's Impact on Mental Health: Understanding the Link

Bimatoprost is a medication commonly used for treating glaucoma and promoting eyelash growth, but its effects on mental health are drawing interest. With an increasing number of reports concerning mood changes or psychological side effects, it's essential to examine the potential connection. This article delves into how bimatoprost works, its known effects, and investigates anecdotal evidence and scientific studies on mental well-being. Considering the medication's benefits and side effects, we offer helpful tips for those prescribed bimatoprost.

Crystal August

January 20, 2026 AT 07:36This is why I refuse to sign anything without a lawyer. Indemnification clauses are traps disguised as protection. You think you're safe, but then you miss a deadline or the wording is vague, and suddenly you're on the hook for millions. It's not about being paranoid-it's about being smart.