Before 1983, fewer than 40 treatments existed for rare diseases in the U.S. Today, more than 1,000 are approved. The difference? Orphan drug exclusivity.

What orphan drug exclusivity actually does

Orphan drug exclusivity is a seven-year period of market protection granted by the FDA to a drug approved for a rare disease. It doesn’t mean the drug is patented. It doesn’t mean it’s the only treatment available. It means that for seven years after approval, no other company can get FDA approval to sell the same drug for the same rare disease - unless they prove their version is clinically superior. The law behind it, the Orphan Drug Act of 1983, was created because pharmaceutical companies had no financial reason to develop drugs for conditions affecting fewer than 200,000 people in the U.S. Why spend $150 million to treat 8,000 patients when you can’t recoup the cost? The answer was exclusivity: guarantee a market, even if it’s small. This isn’t patent protection. Patents cover the chemical structure or how a drug is made. Orphan exclusivity covers the use. A drug can have both. But if the patent expires, the exclusivity still stands - as long as it’s for the same rare disease.How the system works in practice

The process starts with an orphan designation. A company applies to the FDA’s Office of Orphan Products Development, showing the disease affects fewer than 200,000 people in the U.S. or that the drug won’t be profitable without incentives. The FDA approves about 95% of properly filed applications. That approval doesn’t guarantee the drug will work - only that it’s being developed for a rare condition. Then comes the real race. Multiple companies can apply for the same orphan designation. Only the first to get FDA marketing approval gets the seven-year exclusivity. It’s like a horse race where everyone starts at the same line, but only the winner gets the prize. Take amifampridine. It was first approved in 2009 for Lambert-Eaton myasthenic syndrome (LEMS). In 2019, another company got approval for the same drug for the same condition. The FDA blocked it - because the first company still had exclusivity. The second company couldn’t get approval unless they proved their version worked better. They didn’t. So they couldn’t enter the market.What exclusivity doesn’t protect

Orphan exclusivity is narrow. It protects the drug for one specific disease. If the same drug is used for another condition - even if that condition is common - generics can enter. For example, Humira (adalimumab) was originally approved for rheumatoid arthritis, a common disease. Later, the manufacturer got orphan designation for a rare form of uveitis. That gave them seven years of exclusivity for that specific use. But generics could still come out for rheumatoid arthritis. The exclusivity didn’t block competition for the bigger market. This led to criticism. Some companies have been accused of “salami slicing” - applying for multiple orphan designations for the same drug across different rare diseases, just to extend market protection. The FDA has cracked down on this. In 2023, they issued new guidance clarifying what counts as the “same drug” for the same indication.

How it compares to other countries

The U.S. gives seven years. The European Union gives ten. And in Europe, if a company studies the drug in children, they get two extra years. The U.S. doesn’t offer that. The EU also lets regulators cut exclusivity from ten to six years if the drug turns out to be wildly profitable - something the U.S. system doesn’t do. That’s led to debates: is seven years enough? Or is it too much? In the U.S., orphan exclusivity has rarely been the main reason generics haven’t entered the market. According to IQVIA, in 88% of cases, it was patent protection holding back competition - not orphan exclusivity.Why companies rely on it

For small biotech firms, orphan exclusivity isn’t a bonus - it’s the business model. One regulatory affairs manager told a forum in 2022: “Without the seven-year exclusivity, we couldn’t justify spending $150 million to develop a drug for 8,000 patients.” That’s the reality. Without exclusivity, most of these drugs would never be made. The numbers back this up. Before 1983, only 38 orphan drugs were developed in 10 years. Since then, over 1,000 have been approved. The FDA granted over 400 orphan designations in 2022 alone - up from 127 in 2010. Oncology leads the way. Nearly half of all orphan drugs are for cancer. But rare neurological, metabolic, and blood disorders have also seen massive growth.Controversies and criticisms

Not everyone sees this as a win. Some orphan drugs end up costing hundreds of thousands of dollars per year. Patient advocacy groups say exclusivity is essential - 78% told a 2022 survey it’s vital for development. But 42% also said high prices are a major problem. Then there’s the issue of drugs that were already profitable. Humira, for example, made $21 billion in 2022. Only a tiny fraction of that came from its orphan use. Critics argue that giving exclusivity to a blockbuster drug for a rare use is a loophole. The FDA has responded by tightening rules. The “clinical superiority” bar is high. Only three cases since 1983 have met it. That means even if a competitor makes a cheaper version, they can’t get approval unless they prove it works better - not just the same.

What’s next for orphan drug exclusivity

By 2027, Deloitte predicts 72% of new FDA-approved drugs will have orphan status. That’s up from 51% in 2018. The market is growing fast. Global orphan drug sales hit $217 billion in 2022 - nearly a quarter of all prescription drug sales. The EU is reviewing its rules. They’re considering reducing exclusivity from ten to eight years for drugs that earn more than expected. The U.S. hasn’t moved yet. But pressure is building. Some lawmakers want to add a new requirement: proof of “unmet medical need.” Right now, a disease just has to be rare. What if it already has a treatment? Should that still qualify for exclusivity? For now, the system stays. And it still works. Companies invest billions because they know: if they win the race, they get seven years of protection. No generics. No competition. Just the patients who need it.How sponsors plan for exclusivity

Smart companies start early. They file for orphan designation during Phase 1 or early Phase 2 trials - not after approval. That way, they lock in the timeline. The FDA reviews applications in about 90 days, with a 95% approval rate if the paperwork is solid. They also spend 12 to 18 months building their regulatory strategy. That includes hiring epidemiologists to prove the disease is rare enough. They schedule pre-submission meetings with the FDA to avoid surprises. It’s not just about science. It’s about timing. The first to submit a complete application wins. The rest? They’re out of luck - unless they can prove superiority.Real impact, real trade-offs

Orphan drug exclusivity has saved lives. It’s brought treatments to conditions once ignored. But it’s also led to high prices and occasional abuse. The system isn’t perfect. But it’s working. More than 90% of biopharma companies say it’s critical to their rare disease programs. Without it, most of these drugs wouldn’t exist. The challenge now isn’t whether to keep it - it’s how to make it fairer. How do you reward innovation without letting companies game the system? How do you keep prices reasonable when patients have no alternatives? The answer isn’t to scrap exclusivity. It’s to refine it.How long does orphan drug exclusivity last in the U.S.?

In the United States, orphan drug exclusivity lasts seven years, starting from the date the FDA approves the drug’s marketing application. This protection applies only to the specific rare disease for which the drug received orphan designation.

Can a generic version of an orphan drug be approved during the exclusivity period?

Yes - but only if the generic manufacturer can prove their version is clinically superior. That means showing it offers a substantial therapeutic improvement over the original drug, such as better effectiveness, fewer side effects, or improved safety. Since 1983, only three cases have met this standard.

Does orphan exclusivity prevent competition for other uses of the same drug?

No. Orphan exclusivity only protects the drug for the designated rare disease. If the same drug is approved for a common condition - like rheumatoid arthritis - generics can enter that market even if the orphan use is still protected. This is why some drugs, like Humira, have both orphan and non-orphan uses.

What’s the difference between orphan exclusivity and a patent?

A patent protects the chemical structure, method of manufacture, or specific use of a drug. It can last 20 years from filing. Orphan exclusivity protects only the use of the drug for a specific rare disease and lasts seven years from FDA approval. A drug can have both, but orphan exclusivity remains even if the patent expires.

Why do so many companies apply for orphan designation?

Because the FDA approves about 95% of properly filed applications, and the seven-year exclusivity gives companies a guaranteed market - even for small patient populations. It’s a low-risk, high-reward strategy. Many companies file early in development to lock in protection before clinical trials are complete.

Are orphan drugs always expensive?

Not always - but many are. Because the patient population is small, companies often set high prices to recover R&D costs. While exclusivity helps incentivize development, it also reduces price competition. Patient groups support the system but often criticize the resulting high costs.

10 Comments

Write a comment

More Articles

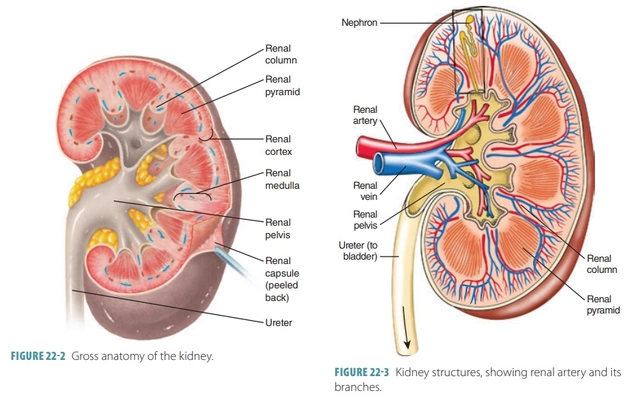

Azathioprine and Kidney Function: What You Should Know

As someone who's always keen on learning about health and medications, I recently came across some vital information on Azathioprine and its impact on kidney function. Azathioprine is an immunosuppressive drug, mainly used to prevent organ rejection after transplantation and to treat autoimmune diseases. While it can be effective for these conditions, it's important to be aware that long-term use may lead to kidney damage, especially in high doses. Regular monitoring of kidney function is essential for those on this medication to ensure they remain healthy. It's always best to discuss any concerns with your healthcare provider to make informed decisions about your treatment options.

Assistive Devices for Managing Rheumatoid Arthritis: Benefits & Tips

Explore how assistive devices-splints, adaptive utensils, mobility aids-help manage rheumatoid arthritis, choose the right tools, and access funding options.

Top Online Pharmacy Alternatives to canadapharmacy.com

Exploring online pharmacies presents several alternatives to canadapharmacy.com, each offering unique benefits. From sites providing comprehensive price comparisons to those ensuring direct access to FDA-approved medications, these alternatives cater to diverse needs. Whether looking for cost savings, user-friendly interfaces, or trusted safety credentials, there's an option for everyone here. Discover and evaluate the best options for convenient and safe prescription buying.

swatantra kumar

November 20, 2025 AT 19:08So we’re basically paying $500K/year for a drug that’s chemically identical to one that costs $50 in India? 🤡 But hey, at least the shareholders are happy! 💸 #OrphanDrugLuxury