A critically acclaimed name in the pharmaceutical sector, AstraZeneca, has seen a significant fluctuation in its revenue charts, particularly drawing attention towards its product, Seroquel. Over the years leading up to 2021, this medication has not only underlined its importance within the company’s portfolio but also marked its territory as one of the flagship products of AstraZeneca. The revenue generated from Seroquel alone signified a substantial spike in 2021, with an estimated earning of around 1.3 billion U.S. dollars, establishing it as a top revenue-generating product for the company in the said year.

Amid these financial revelries, AstraZeneca prepared to unveil its first-quarter results for 2023 on April 27, 2023. The introduction of the 2022 financial outcomes showcased a concoction of highs and lows, significantly impacted by various factors including the acquisition of Alexion, a move that rippled through their fiscal metrics. Beyond acquisition costs, AstraZeneca's financial health bore markings of amortization of intangibles, impairments, restructuring charges, and a notable legal settlement with Chugai Pharmaceutical Co. Ltd.

The financial documents meticulously highlight a breakdown of revenues, gross profits, operating losses, amongst other imperative fiscal markers, providing a transparent view into the company’s economic stance. Alongside, the year 2023 marked a pivot for AstraZeneca with the initiation of its sustainability strategy, a venture to be commandeered by Pam Cheng, Executive Vice-President of Operations and Information Technology. This step aligns with the company’s long-term visions towards a sustainable future in pharmaceuticals, ensuring their operations tread lightly on the environmental frontal.

AstraZeneca's competent handling and strategic expansion into various divisions such as Oncology, CVRM, R&I, and Rare Disease, have all reported experiencing double-digit growth as we stepped into 2023. This surge mirrors the company’s adept response to the evolving pharmaceutical landscape, ensuring that they stay at the forefront of innovation and care. Moreover, the decline in sales of lower-margin COVID-19 medicines shifted the company’s core product sales gross margin upwards by two percentage points, a reflection of its evolving product lineup catering to non-pandemic related health concerns.

The narrative of the company’s financial ascent does not end here. With a commendable increase in AstraZeneca’s core operating margin by two percentage points, inclusive of a $712 million gain stemming from an update to the contractual relationships for Beyfortus, the company’s tactical financial management paints a picture of resilience and calculated ventures into profitable realms. Furthermore, the company declared a second interim dividend of $1.97 per share, culminating the total dividend for FY 2023 at $2.90 per share. This move not only reflects the company's stable financial posture but also reassures its shareholders of the sustained value generation AstraZeneca is committed to.

Looking ahead, AstraZeneca's trajectory seems poised for continued growth, with an anticipation of both total revenue and core earnings per share to burgeon by low double-digit to low teens percentages at constant exchange rates in FY 2024. This projection encapsulates the company’s thrust towards leveraging its financial and innovative prowess to scale new heights, ensuring that AstraZeneca remains a beacon of pharmaceutical excellence and innovation in the years to come.

18 Comments

Write a comment

More Articles

How to Buy Acamprol Online Safely: Step-by-Step Guide and Tips

Discover how and where to buy Acamprol online safely, with tips on finding reliable pharmacies, understanding costs, and protecting your health.

Outcomes Economics: The Real Cost-Benefit of Using Generic Medications

Generics save money - but do they save health? Outcomes economics reveals how generic drugs impact adherence, hospitalizations, and long-term costs, backed by real-world data and patient outcomes.

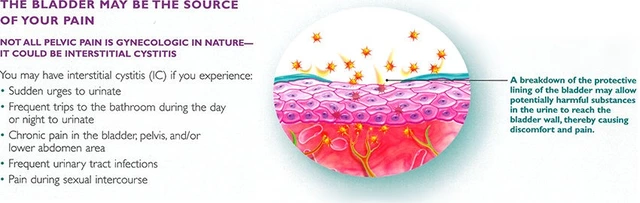

The Role of Diet in Preventing and Managing Cystitis

As a blogger, I cannot stress enough the importance of diet in preventing and managing cystitis. A balanced and healthy diet, rich in fresh fruits, vegetables, and whole grains, can help boost our immune system and prevent urinary tract infections. Drinking plenty of water and avoiding caffeine, alcohol, and spicy foods are crucial in managing cystitis symptoms. Including natural supplements like cranberry and D-mannose can also be helpful in preventing recurrent infections. Overall, our diet plays a significant role in maintaining a healthy urinary system and preventing cystitis.

Lori Johnson

March 23, 2024 AT 02:42Seroquel made 1.3 billion? That’s wild. I wonder how many people are on it just to sleep. I’ve seen friends on it for anxiety and it’s like they’re zombies. 😅